Fraudsters Continue to Target Check Payments

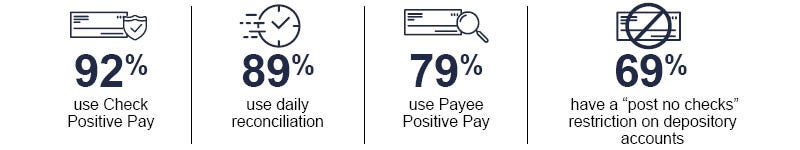

A large majority of organizations are still using checks for outgoing payments and checks continue to be the primary target of payments fraud. Without preventative measures in place, every check payment could be exposing an organization to fraud. AFP reported the following as tools and processes companies have implemented to protect their business:

ACH Fraud On The Rise

As more companies make the transition from paper checks to electronic payments, the Association of Financial Professionals reported an increase in the number of organizations experiencing ACH credit fraud in 2022. When transitioning to electronic payments it is essential to update policies and procedures to ensure the business is still protected against fraud.

With Same Day ACH limits increasing from $100,000 to $1 million, it’s even more important for businesses to be extremely vigilant when it comes to daily reconciliation and recognition of possible fraudulent ACH transactions. AFP reports only a small portion of organizations have implemented mitigation plans:

Taking precautionary measures can help reduce an organization’s exposure to ACH fraud. Those surveyed by AFP reported using the following tools and practices to mitigate fraud:

Credit Card Fraud Revived

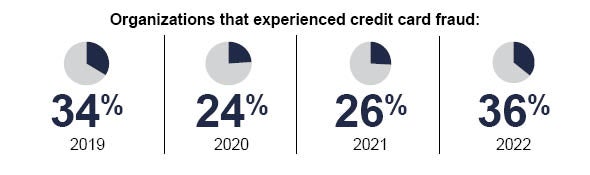

Many businesses are returning to pre-Covid operations, which includes employee travel. 2020 saw a 10% decrease in corporate credit card fraud, mostly likely due to travel restrictions, which resulted in a decline in employee credit card usage. But as business travel started picking back up, so did corporate credit card fraud.

With credit card fraud increasing by 10% in 2022, card fraud that’s initiated through stolen credit cards becomes a concern for businesses. Liability policies offered by card providers can give organizations peace of mind in knowing they may not be liable for fraudulent charges. Since corporate credit cards aren’t tied directly to a bank account, you can make purchases without exposing your company’s assets to fraud.

Fraud vs. Misuse

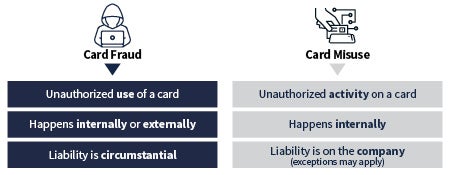

Although the two may seem similar, card fraud and misuse of a card are very different. Knowing how to protect your card program from both leads to more efficient controls.

Combat Commercial Credit Card Fraud

Tools and features of Commercial Credit Cards may help mitigate fraud and misuse:

- Fraud Alerts- Notification of unusual activity

- Merchant Category Code (MCC) Controls- Restrict specific industry purchases

- ATM Blocking- Restrict cash withdrawals at ATMs

- Spending Limits- Customize single and monthly transaction limits per card/program

- VISA’s Zero Liability Policy- Protection from fraudulent transactions, and some exclusions apply, provisional credits will be applied after a prompt notice

- VISA Liability Wavier Program- Protects your business against eligible losses that may be incurred through card misuse by an employee

Commercial Credit Card Best Practices

- Establish Roles and Responsibilities

- Program Administrator (PA) – Takes care of daily administrative needs such as add/cancel cards, adjusts credit limits, makes payments, ensures policies and procedures are being followed, and performs reconciliations

- Cardholder- Makes purchases on behalf of the company and abides by procedures and policies

- Approver- reviews transactions for legitimacy

- Require a Cardholder Agreement

- Outlines cardholder responsibilities and consequences of not following policies

- Separation of Duties

- More separation allows for easier detection of a problem

- Transaction Audits

- Regularly review transaction history to identify any suspicious activity. Transactions to look out for include:

- High-dollar and/or abnormal transactions

- Transaction splitting to cheat transaction limits

- Certain suppliers/MCCs

- Transactions that don’t align with the business

- Transaction volume

- Declined transactions

- New cardholder- monitor transactions for at least 3 months

- Review detailed transaction data, including declined transactions and dates

- Easily identify spending partners and discover unusual transactions

- Carefully manage expenses

- Regularly review transaction history to identify any suspicious activity. Transactions to look out for include:

Technology to the Rescue

Just as fraud attempts have become more sophisticated, technology continues advancing to help fight it. Consider the following:

Detailed Reporting

Keeping a close eye on your accounts can help you to quickly identify and recover fraudulent transactions. Having an intuitive account management platform can simplify fraud monitoring.

Integrated Payables

Integrated Payables is a payments strategy that better protects your business, streamlines your daily operations, and saves resources. This is ONE payment solution for all vendor payment types: Check, ACH, and Virtual card.

Download Fraud Prevention Guide

Source:

Association for Financial Professionals: 2023 Payments Fraud and Control Survey Report

All Pertinent Disclaimers:

As with all serious financial topics or decisions, be sure to consult with a trusted financial advisor beforehand. The content here is for educational purposes only and is not meant to serve as any sort of advice or endorsement.