Your business probably receives daily invoices for payments. Have you considered the steps, manpower and security of your payment method?

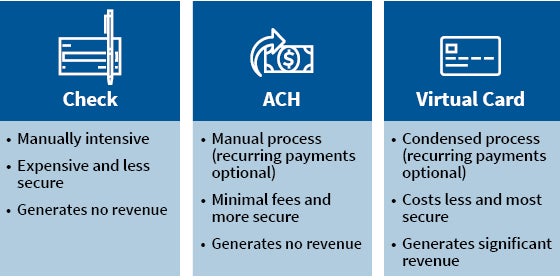

Cutting a check can take upwards of ten steps and is very unsecure, while ACH and credit card are quicker and more secure. If the latter two are used less frequently, your business is probably not maximizing your accounts payables process. By developing a solid payments strategy, both your business and your vendors will benefit. You can maximize your ability to earn revenue, improve cash flow and streamline processes with a strong payments strategy in place.

What is a Payments Strategy?

A payments strategy is a variety of flexible payment types that bring value, efficiency and benefits to your business. It should consider all the factors that can affect when and how the payment is made. With the right payments mix, both your business and your vendors can benefit:

- Save time and money by automating vendor payments

- Improve cash flow by paying your vendors now and paying Retirement Plan Services when your statement is due

- Vendor enrollment is handled by our team, taking the burden off your business and your vendors

- Add a recurring revenue stream by earning revenue share

- Make more informed financial decisions with robust reporting

- Greater visibility leads to better fraud risk management

Do you have a Payments Strategy? What Should It Include?

As you determine if your business has an effective payment strategy in place, you might consider the following questions:

- What does your payment process look like?

- Do you know the different costs associated with these payments?

- Have you ever asked your vendors what different payment types they will accept, and/or if they would consider a different type?

- Did you know you could earn revenue share from your payments?

- Can prolonged DPO (Days Payable Outstanding) help you increase cash flow?

- Do you have fraud protection processes and tools in place?

A Strong Payments Strategy Includes a Variety of Payment Types:

An efficient and optimized payments strategy helps both your business and your vendors leverage technology to achieve faster and higher revenue growth. A combination of flexible payment methods includes:

What Can a Payments Strategy Do for My Business?

When an effective payments strategy is in place, your business can leverage prompt payments to obtain vendor discounts, allowing you to negotiate better terms and grow your partnerships. Plus, you can decrease costs, streamline operations, minimize fraud risk, increase reporting capabilities, and gain back hours from your employees - reducing time spent managing the payments process, vendor relationships and reconciling accounts. While this will require some process updates, it will add great value to your bottom line and help your business grow.

At Dubuque Bank & Trust, a division of HTLF Bank, we want to help you cultivate a successful business by optimizing your payments strategy. Partners work together, and we’re ready to help move your company forward with informed clarity and confidence. Reach out to us and we’ll get started today!